sales tax rate in tulsa ok

4 rows The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa. Rates and Codes for Sales Use and Lodging Tax.

Oklahoma Sales Tax Information Sales Tax Rates And Deadlines

You can find more tax rates and allowances for Tulsa and Oklahoma in the 2022 Oklahoma Tax Tables.

. Basic understanding of income tax. Broken Arrow OK Sales Tax Rate. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions.

Del City OK Sales Tax Rate. The average cumulative sales tax rate in Tulsa Oklahoma is 831. The Tax Commission collects sales taxes on behalf of the State City and the County.

Automating sales tax compliance can help your business keep compliant with. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. Who is exempt from the tax.

Payroll and sales tax preparation. Bixby OK Sales Tax Rate. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11.

Has impacted many state nexus laws and sales tax collection requirements. Ardmore OK Sales Tax Rate. In principle tax receipts should be same as the amount of all yearly funding.

Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115. Under a consolidated tax bill almost all sub-county entities reach. This includes the sales tax rates on the state county city and special levels.

The Oklahoma state sales tax rate is currently. The Oklahoma sales tax rate is currently. Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65.

Stanfield ODell is currently seeking a Staff Accountant with 3 years of. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. A permanent resident One who occupies or has the right to occupy any room or rooms in the hotel for at least 30 consecutive days.

Ada OK Sales Tax Rate. Every entity establishes its independent tax rate. To review the rules in Oklahoma visit our state-by-state guide.

The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. Tulsa has parts of it located within Creek County Osage County and Tulsa County. Claremore OK Sales Tax Rate.

Tulsa Sales Tax Rates for 2022. Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402. Free Unlimited Searches Try Now.

2022 Oklahoma state sales tax. Altus OK Sales Tax Rate. Some cities and local governments in Tulsa County collect additional local sales taxes which can be as high as 51.

The base state sales tax rate in Oklahoma is 45. State of Oklahoma - 45 Tulsa County - 0367 City - 365. Bartlesville OK Sales Tax Rate.

The current total local sales tax rate in Tulsa OK is 8517. Find your Oklahoma combined state and local tax rate. 7288 TULSA CTY 0367 7388 AGONER CTY W 130 7488 ASHINGTON CTY W 1 7588 ASHITA CTY W 2 7688 WOODS CTY 050 7788 WOODWARD CTY 090.

892 Is this data incorrect. Bethany OK Sales Tax Rate. 1912 Bristow 4 to 5 Sales and Use Increase July 1 2021 5805 Commerce 4 to 3 Sales and Use Decrease July 1 2021.

Oklahoma has numerous local governmental entities including counties and special districts such as public schools healthcare facilities and sewer treatment districts. Oklahoma sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa County totaling 037.

There are a total of 469 local tax jurisdictions across the state collecting an average local tax of 4247. 608 rows Average Sales Tax. The tax must be paid on the occupancy or the right of occupancy of rooms in a hotel.

Tulsa OK 74119 Riverview area Estimated 529K - 669K a year. Exact tax amount may vary for different items. Ad Get Oklahoma Tax Rate By Zip.

450 The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa Tulsa collects a 0 local sales tax less than the 2 max local sales tax allowed under Oklahoma law Tulsa has a lower sales tax than 997 of Oklahomas other cities and counties. The current total local sales tax rate in Tulsa OK is 8517. The City of Tulsa imposes a lodging tax of 5 percent.

However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in. Tulsa County Sales Tax Rates for 2022. The 2018 United States Supreme Court decision in South Dakota v.

The Tulsa County sales tax rate is. Within Tulsa there are around 50 zip codes with the most populous zip code being 74133. Duncan OK Sales Tax Rate.

This is the total of state county and city sales tax rates. You can find more tax rates and allowances for Tulsa County and Oklahoma in the 2022 Oklahoma Tax Tables. What is the lodging tax rate.

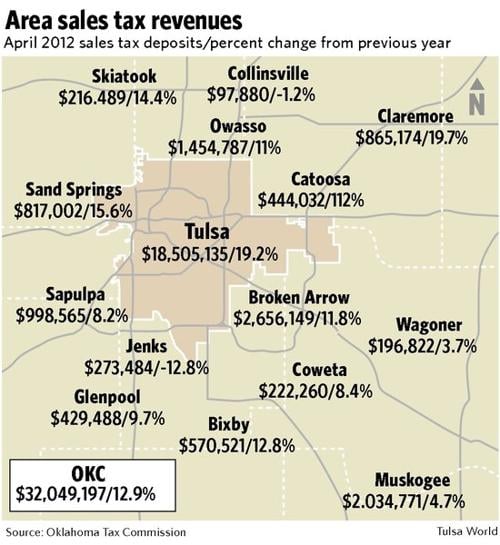

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Thinking About Moving These States Have The Lowest Property Taxes

How Oklahoma Taxes Compare Oklahoma Policy Institute

How To Calculate Cannabis Taxes At Your Dispensary

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Oklahoma Sales Tax Small Business Guide Truic

How To Charge Sales Tax On Avon Orders Youtube

Sales And Use Tax Rate Locator

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Use Tax For County Government Oklahoma State University

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Cutting The Top Income Tax Rate Who Benefits Oklahoma Policy Institute

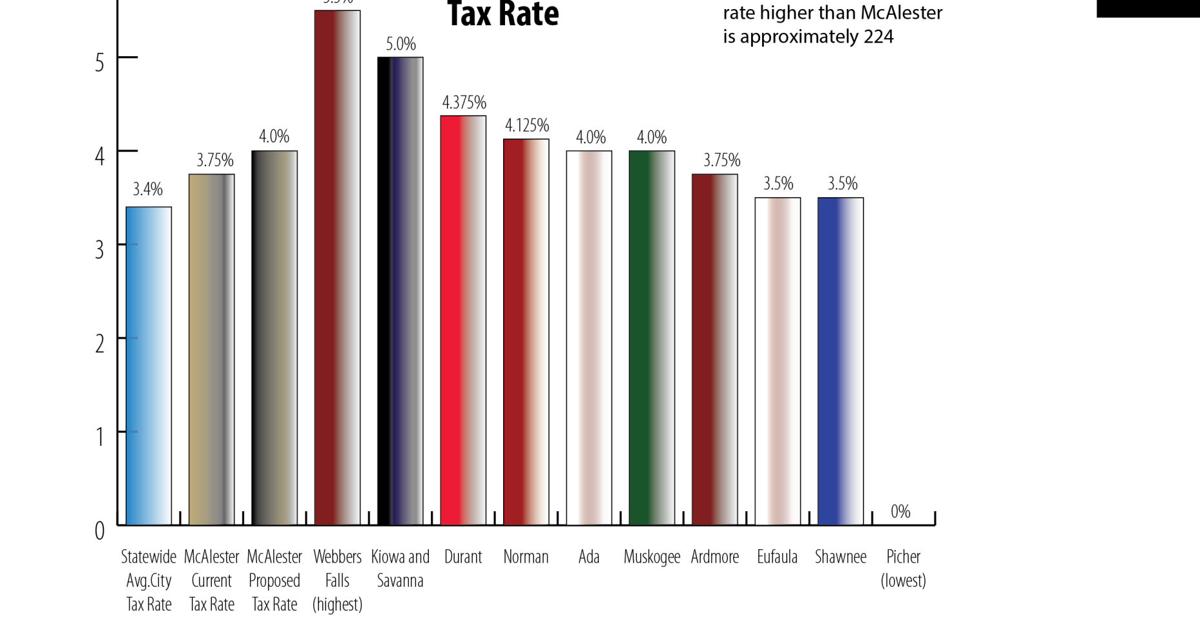

Many Sales Tax Rates Across Oklahoma Higher Than Mcalester S Local News Mcalesternews Com