tax shelter real estate definition

448d3 which states that the term tax shelter has the meaning given such term by section 461i3 Sec. However when the claims are exaggerated those tax deductions change.

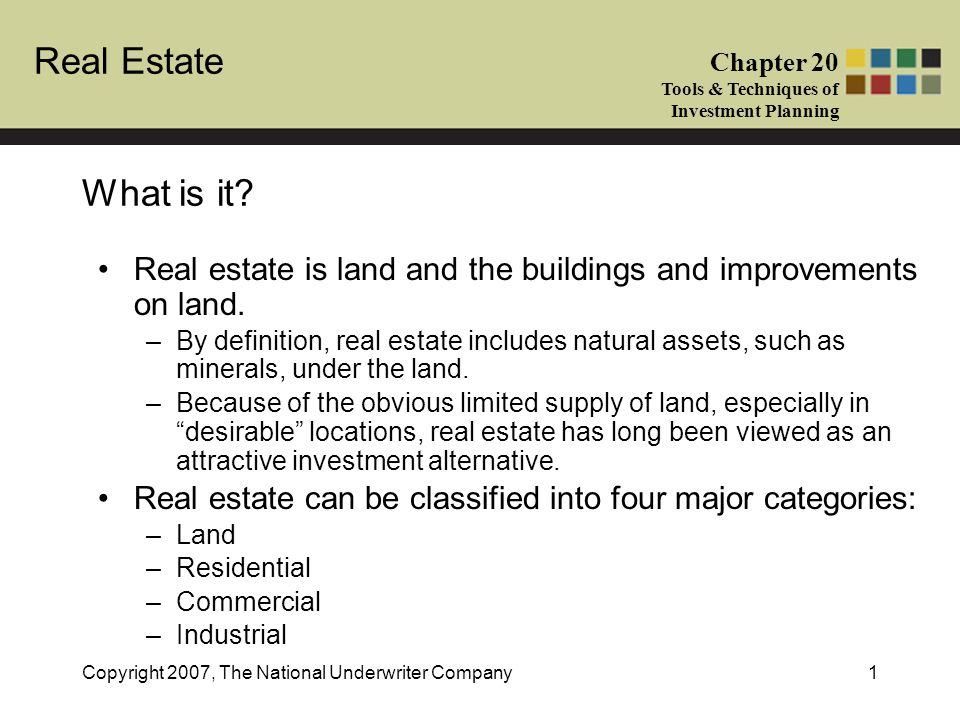

What Is It Real Estate Is Land And The Buildings And Improvements On Land By Definition Real Estate Includes Natural Assets Such As Minerals Under Ppt Video Online Download

A tax shelter is a place to put your money where it will be safe from the long arm of the Tax Man.

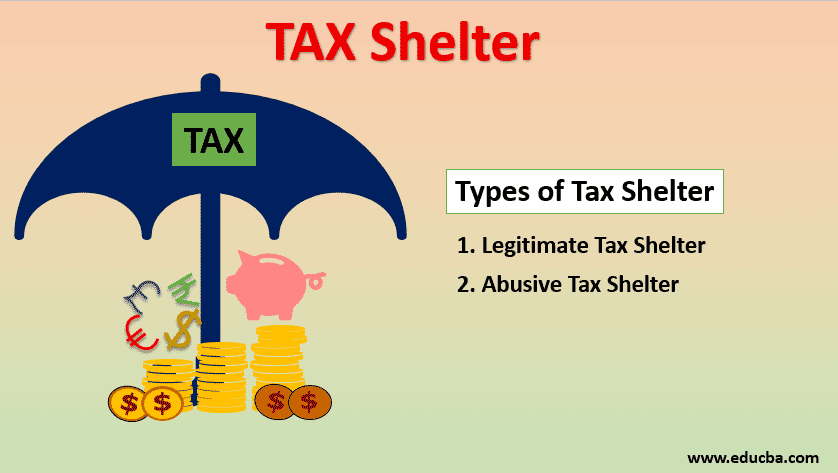

. The equipment leasing tax shelters which provide investment. A tax shelter is advantageous by the taxpayers in high tax brackets so they can take losses from it to reduce their taxable income. Most business owners depth of understanding of a tax shelter is that it has something to do with the avoidance or evasion of tax which makes sense.

A tax shelter reduces a propertys taxable income. Traditional tax shelters have included investments in real estate oil and gas equipment leasing and cattle feeding and breeding programs. The result is that rental real estate is a secret tax shelter that few people ever consider.

A tax shelter is used to lower the amount owed in taxes in a legal manner as defined by the IRS and the tax code. One of the tax shelters is to invest in real estate but in reality each real estate is a separate entity on its own. It allows you to channel your hard-earned money into income-generating assets such as real estate syndications apartment complex buying and other profitable streams of income.

Jason Heath Financial Post. A number of real estate tax shelter exist. Definition of Abusive tax shelter.

448a3 prohibition defines tax shelter at Sec. Think of tax shelters as your financial bottom lines best friend. Common examples of tax shelters are home equity and 401k accounts.

Many people think of tax shelters negatively but they are completely legal and legitimate ways to decrease your taxable income. A tax shelter is defined differently under various Code sections with one of the broadest definitions used in this case. A Secret Tax Shelter.

Real estate investors have a few unique tools to minimize their tax burden. The problem is there is simply no money to be made by financial professionals when it comes to rental real estate. 461i3 provides that the term tax shelter.

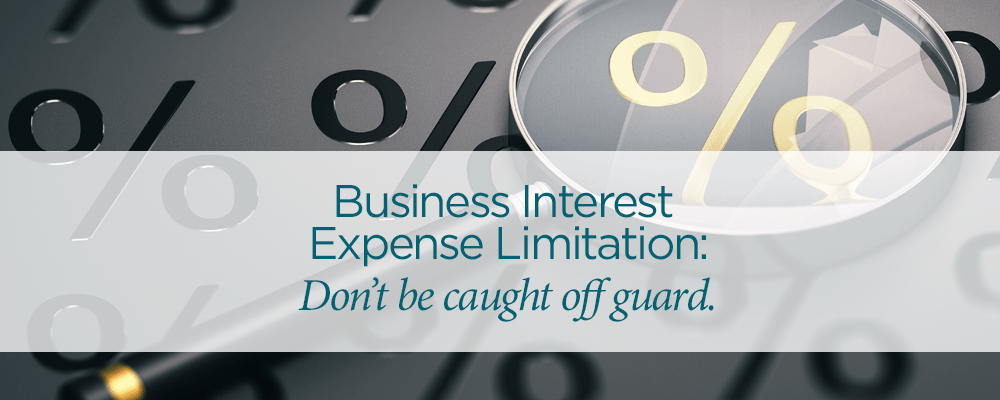

A tax shelter as cumulatively defined by IRC Sections 448 1256 and 461 is any partnership or entity other than a C corporation that has more than 35 of losses in a tax year allocable to limited partners or limited entrepreneurs. It protects your wealth. While those reactions are most assuredly true the proclamations were made at a time when there was substantial.

On the other hand tax evasion is used to lower the amount of taxes owned by using intentionally illegal methods that are considered a federal offense and punishable by law. Abusive tax shelters are a consequence that resulted from Congress allowing losses of revenue to be used for tax benefits. Murphy Real Estate Agent Keller Williams Realty Atlanta Metro East.

The ready to use real estate property has two phases under construction and the other one is the developed phase. A tax shelter is different from a tax haven which is a place outside of the country. The tax shelter and passive activity losses.

Financial Post Real Estate. It is a legal way for individuals to stash their money and avoid getting it taxed. Using this definition a tax shelter might allow you to invest for example 100 and then take a deduction for 400 at the end of the year.

You should always consult with a professional but for a general overview check out A Beginners Guide Real Estate Tax Deductions Commercial vs. There is a penalty of 1 of the total amount invested for the failure to register a tax shelter. A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source.

The term tax shelter means. Two of the biggest tax deductions are mortgage interest and depreciation. The real estate tax shelters which provide interest and deprecia-tion deductions on a leveraged acquisition of real estate some-times with some form of government subsidy through tax exempt government bond financing or interest payment guarantees.

They are a side-effect of tax deductions that companies are entitled to claim. View the definition of Tax Shelter and preview the CENTURY 21 glossary of popular real estate terminology to help along your buying or selling process. Any enterprise other than a C-Corporation if at any time interest in such enterprise have been offered for sale in any offering required to be register with any Federal or State Agency has the authority to regulate the offering of securities for sale 2.

Real Estate Partnerships and the Looming Tax Shelter Threat article Many touted the tax reform legislation known as the TCJA as the most significant change to the Internal Revenue Code IRC since the Tax Reform Act of 1986. Did you spot it. As an example lets assume that a property has a cash flow of 5000 in other words the cash income from the property exceeds cash expenditures by 5000 for the year.

Historically real estate has proved to be a significant tax shelter. The IRS allows some tax shelters but will not allow a shelter which is abusive. So the investor has 5000 spendable cash in his or her pocket.

That is what real estate tax shelters are for. The failure to report a tax shelter identification number has a penalty of 250. A tax shelter is a financial vehicle that an individual can use to help them lower their tax obligation and thus keep more of their money.

The definition of a tax shelter therefore becomes a critical factor in determining tax consequences for a business that otherwise could be a small business.

Tax Shelters For High W 2 Income Every Doctor Must Read This

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

Tax Shelters Definition Types Examples Of Tax Shelter

Tax Shelter Definition Capital Com

Tax Shelter Difference Between Tax Shelter And Tax Evasion

What Is It Real Estate Is Land And The Buildings And Improvements On Land By Definition Real Estate Includes Natural Assets Such As Minerals Under Ppt Video Online Download

/GettyImages-88305470-22488417871f4c6b8bd85f13d6766ccc.jpg)

Tax Haven Vs Tax Shelters Is There A Difference

How Physicians Can Shelter W 2 Income With Real Estate Professional Status Reps

Irs Issues Guidance For Businesses That Elect Out Of Interest Expense Limitations

What Is The Definition Of Tax Shelter Business Interest Expense

Tax Shelters For High W 2 Income Every Doctor Must Read This

What Is It Real Estate Is Land And The Buildings And Improvements On Land By Definition Real Estate Includes Natural Assets Such As Minerals Under Ppt Video Online Download

What Is A Tax Shelter And How Does It Work

Using Your Real Estate Investments As A Tax Shelter

6 Legal Tax Shelters To Consider

Tax Deductions On Rental Property Income In Canada Young And Thrifty

Tax Shelters For High W 2 Income Every Doctor Must Read This

/dv740090-5bfc2b8b46e0fb00265bea71.jpg)